Here’s How Short-term Financing Can Help Increase Profits of Your Business

For every budding entrepreneur to an already established-and-running enterprise, the ultimate goal in business is to show profitability for the countless efforts in store.

Whether you plan on opting for short-term profitability or long-term security depends purely on your brand’s core values, goals and objectivity. According to the 2016 Small Business Credit Survey, many small businesses, despite showing profitability in their attributes, invested personal assets and collateral instead of seeking alternative financing routes for significant brand growth.

Long-term financing can help secure your business’s legacy for the forthcoming future, given you save your brand from experiencing any shortfalls, harsh expenditure, and invisibility in the market during the time.

Short term financing, on the other hand, might be a tough risk, but it is highly lucrative as it increases profitability of your business rapidly. Moreover, it also opens a can of opportunities for swerving through competition in the market and gives you a reason for staying vigilant at all times.

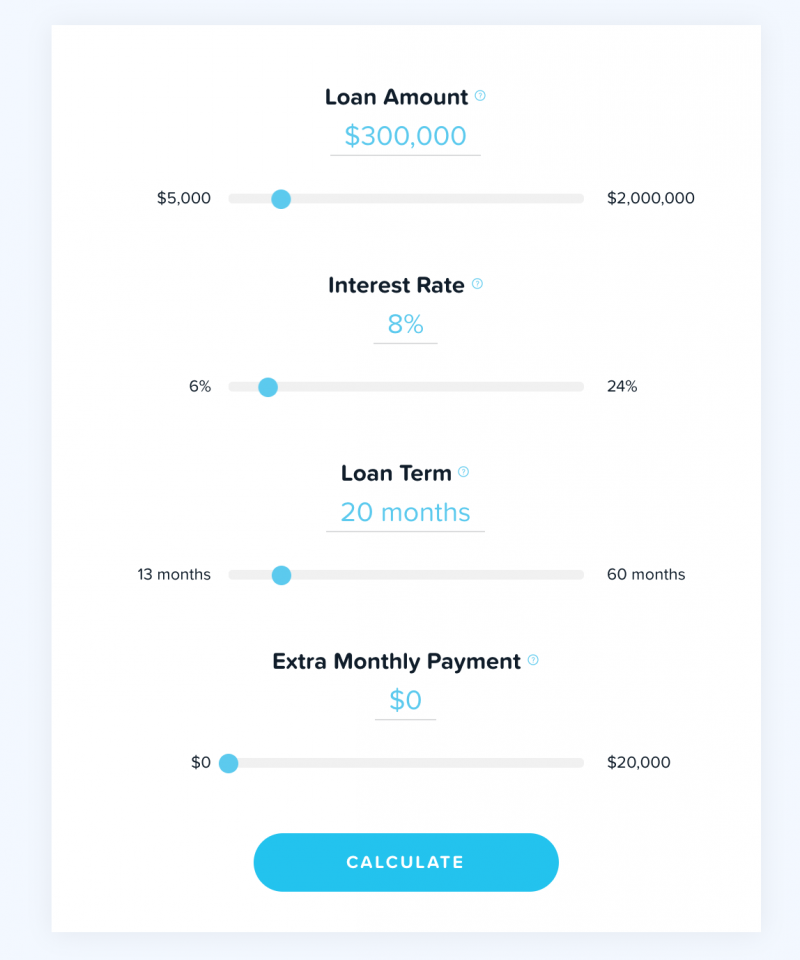

Here is a brief example of how to calculate your short term business loan with monthly down payments and interest rates.

Consider the following advantages of seeking small business loans or working capital for your brand’s growth.

Contents

ToggleAdditional Funds for State-of-the-art Marketing Strategies

To leverage your brand within the target audience, you have to up your marketing campaigns and channel your business towards significant awareness, visibility, and recognition in the market. Funds acquired via short term financing enable you to focus on keen, competitive and trendy marketing strategies that keep your audience interested and motivated.

Your brand will continue to have zero exposure if your marketing campaigns aren’t planned out, designed, and executed authentically. Your marketing campaign serves as the face of your business, enabling people to recognize your brand value and worth in addition to the products and services you offer.

Therefore, short term financing help you invest in promotions, advertisements, and miscellaneous inbound marketing strategies that will in turn boost profitability of your business by raising awareness of your brand.

Brands that don’t focus on short-term financing routes focus on marketing strategies that aren’t either robust to surpass through or have barely any funds to begin with. Small business loans for short term financing proportionally increased from the 1990s as shown below.

Strategic Excellence and Rewards

Since the backbone of your company depends on the threshold, rigorous efforts, and creativity of your employees, short term financing helps you to reward them when required. Rewards boost the morale of your company, which in turn, motivates your employees to either stick to the status-quo or improve their work ethic and standards.

Moreover, this gives your employees a sense of achievement which in turn helps raise their accountability and loyalty for your company. By rewarding employees with bonuses and raises, you not only provide them with a sense of financial security, but job security as well.

Delivers Sense of Achievement

Businesses that focus on acquiring small business loans for financing on a short-term basis, relinquish their success achieved by committing to their short goals.

Short term profitability delivers a sense of achievement, mainly because this provides proof that your business model is not only authentic but works. It denotes acceptance from the consumers and provides significant proof of the workability and scalability of your brand.

With short term profitability, you can decide whether to upgrade your finances and company with long-term investments or acquire small business loans for another short-term milestone.

If you shy away from your strategies, you might not be able to accept your success in the short-term. Short-term profitability therefore, boosts the morale and confidence of your business, allowing you to believe in your product and expand your services for a better yet risky outcome in the future.

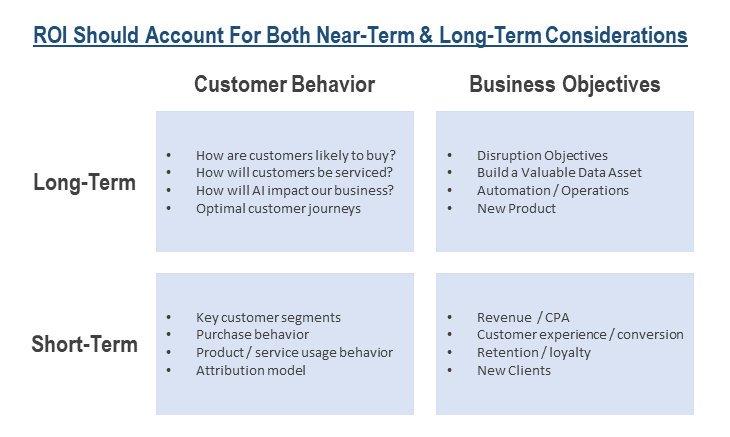

Customer behaviour and business objectives of both long-term and short-term financing in comparison are shown above.

Helps to Counteract Hidden Expenses

Due to inadvertent crash of the market, your business can suffer big time, especially if you’re just starting out and have invested your savings towards its growth. Since small business loans for short term financing, such as those offered by angel investors or hard money lenders require payback of the principal amount, it becomes easy for the investor to seek funds to cover hidden expenses instantaneously.

Most angel investors or lenders who offer SBA loans provide immense flexibility, albeit, in exchange for personal collateral until your demands and expenses are met with accordingly. With the help of short financing alternative routes, you can not only replenish your inventory, but also rehabilitate your company by paying pending salaries and costs of equipment and software amidst other expenditures.

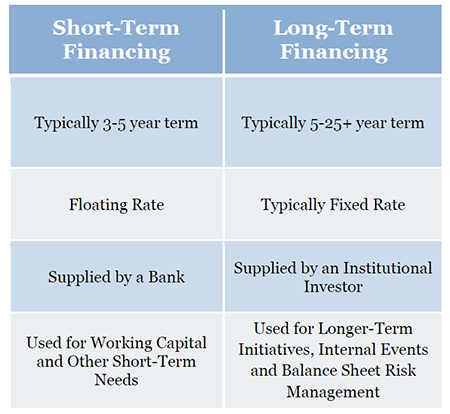

Have a look at the differences between long-term and short-term financing.

Helps to Develop Personal Credit History

To acquire future small business loans, most investors require a good credit score before they commit to lending funds for your business. With finances readily available in the short term period, you can pay off your contractors, suppliers, and vendors, before you’re billed with interest that’s non-payable as well.

By paying vendors and employees, your company achieves a good record of financial statements to show to other prospective B2B brands. This prevents your business from stalling through and faltering its growth in the market.

A good record of personal credit adds to the history of your score that should be maintained by an expert accountant or bookkeeper at your company.

The Final Verdict

With the help of short-term financing, your business wouldn’t have to worry about covering any expenses – whether they involve paying your employees way more than what’s being offered in the market or hiring new staff members as well. Your profits will help you to scale your hidden expenses, boosting your brand’s presence before consumers and vendors as well.

Recommended For You

10 Ideal Email Marketing Services for Small Business

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.