Mulland Fraser – What To Know About Retirement Planning?

This post was last updated on March 19th, 2024

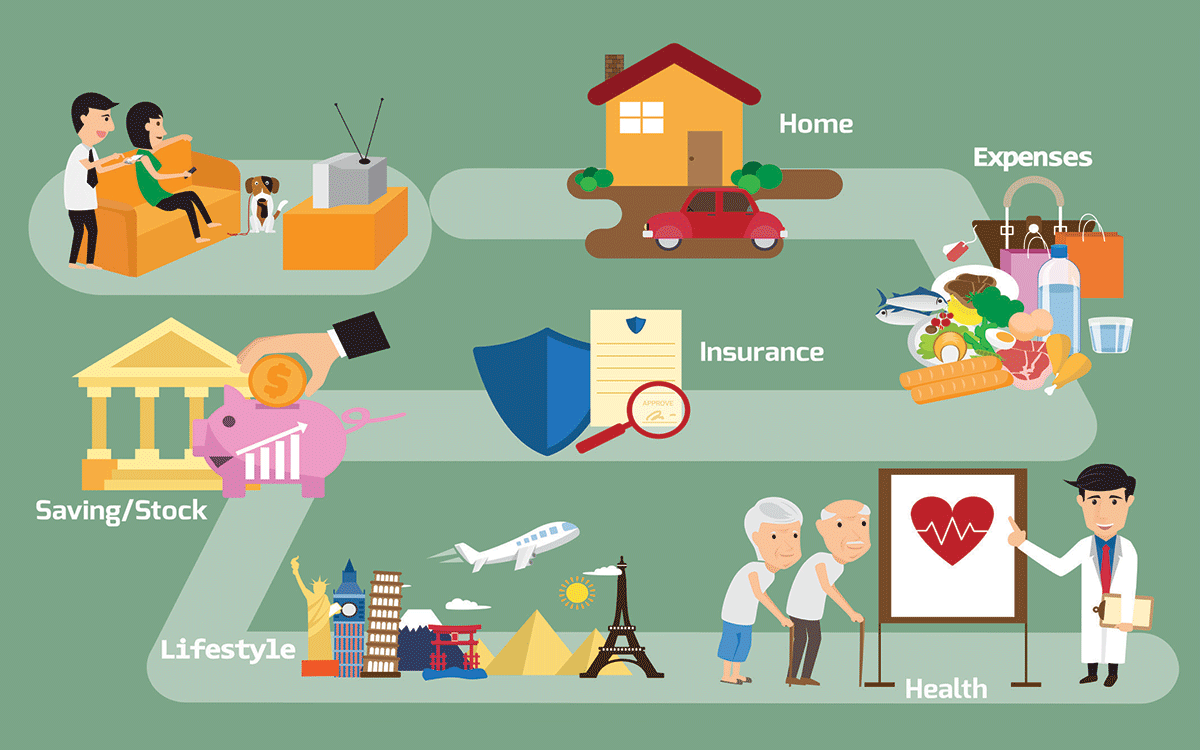

Every professional eventually retires, and the average age of retirement is 66 nowadays. The planning process for retirement includes setting savings and income targets, as well as making informed investment selections. Expenses must be calculated, as well as active and passive sources of income, savings programs, and asset management.

Considering that saving for retirement is part of a lifetime’s worth of work, it’s never too early to get started, but the power of compound interest may really boost your nest egg if you start young. The purpose of retirement planning is to establish whether or not one’s desired level of income in retirement can be attained by estimating current and future cash flows. Follow this link to discover more https://mintgenie.livemint.com/news/personal-finance/retirement-planning-simple-steps-to-go-about-building-your-corpus-151664536215367.

Individuals can ensure their continued financial security and independence in retirement by setting aside a portion of their earnings while they are employed in order to have some economic security as well as spending room once they have ended their working years. Distinct people have different retirement plans because they have various retirement savings objectives, retirement spending aspirations, as well as retirement lifestyle choices.

Contents

ToggleHandling unexpected medical events

It’s not always possible to know what’s going to happen in the future. Who can predict it, right? When it comes to retirement savings, nothing is more important than taking into account the rising cost of healthcare. Without financial security, getting older can be stressful because of the increased likelihood of requiring expensive medical treatment for complex problems.

Health care costs and healthcare inflation are rising at a frightening rate. Therefore, people need a secure retirement plan that can provide for their spouse and themselves in the event of a medical or financial emergency. Check out this page for more.

Battling inflation

When preparing for retirement, it’s crucial to take inflation into account. The price of common necessities is rising. The cost of these necessities will rise significantly throughout the course of a job, making them significantly more expensive than they were at the beginning of a profession. In order to keep up with the cost of living, an individual needs to put away more cash than they might initially believe is required. economic forecasting, anticipating changes in living standards, and investing to mitigate inflation.

Guarantees economic freedom

A successful retirement plan eliminates the need for retirees to rely on their families for financial support once they stop working. For many years, retirees’ kids and friends have covered their basic living expenses. It can be difficult for many people to meet their basic necessities without supplemental income and dwindling family and community support. By planning ahead, one can assure that they will be financially independent in retirement and not have to rely on others.

Protecting your valuables

Many people, by the time they reach the end of their working lives, have amassed significant property and investment holdings. Numerous people may have to sell off valuable possessions and assets in order to fund their retirements if they do not have access to a pension or other retirement savings plan. Putting together a retirement plan is a great way to ensure one’s wealth and property are preserved for one’s offspring and future generations.

Benefiting from returns of investment

People should start putting money away for retirement with a company like Mulland Fraser or plenty of others as soon as they can so that their savings have more time to grow with the help of compound interest. This will allow them to stick with a manageable savings plan for longer, increasing their chances of realizing the benefits of compound interest. As a result, retirement preparation extends the time over which investors reap the benefits of their savings and assets.

Maintaining equilibrium during changes

Every person goes through transitions in life, some of which may require quick action. These adjustments may need to be made quickly, possibly within a budgetary constraint. It could be due to residents changing jobs, switching industries, or moving to a new area. Many people put off pursuing their education until later in life, but that doesn’t mean they can’t do it. Planning for retirement makes the change less disruptive to one’s life and finances.

Recommended For You

Ways to Get an Instant Personal Loan Online In India?

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.