Choosing the Right Investment App: What to Look For

The fast-growing world of app-based investing has been a game changer for both new and experienced investors. These apps simplify investing and provide equal access to the stock market and other investment opportunities. However, the vast number of apps often raises questions about which is best for the user.

Consider the following main elements when selecting the most appropriate investment app that meets your financial needs:

Contents

ToggleUser Interface

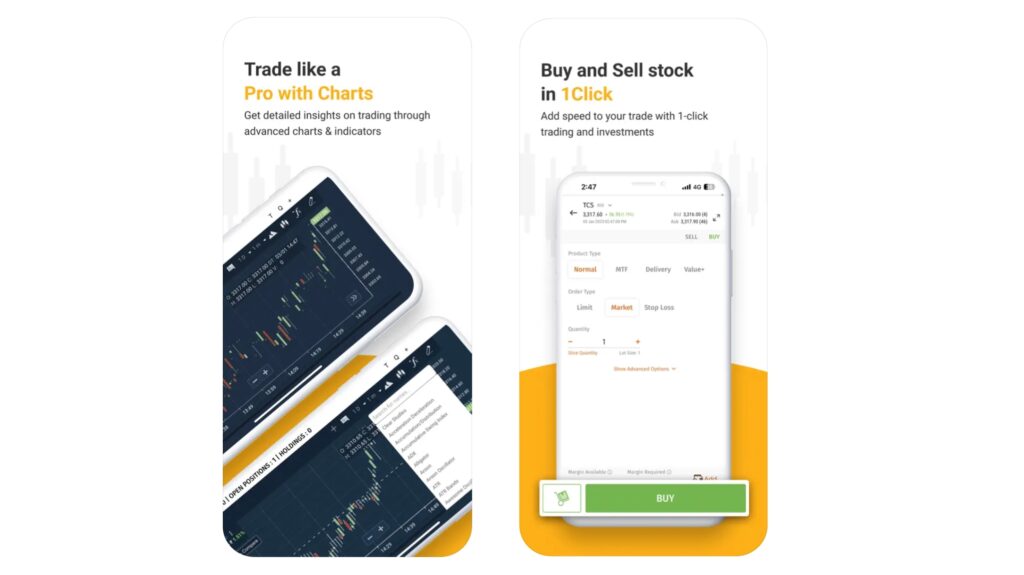

The role an investment app plays for users depends significantly on the quality of the user interface (UI). A cluttered or disorganized UI can lead to mistakes. An app with a simple and elegant interface that allows you to see everything you need right within the app and offers easy-to-use features is best suited for your investment style.

Security Measures

Financial data is very sensitive, so privacy should be a major concern. To comply with data security guidelines, financial information should be kept private. Ensure that the app takes sufficient security measures, such as two-factor authentication, end-to-end encrypted transmission, and secure servers. It is also a good idea to review the app’s history on how it has handled user data and privacy.

Fees and Costs

The app’s compatibility with your existing financial accounts is paramount. Some mobile apps charge per transaction, others levy monthly or annual fees, and some offer no-fee trades. Additionally, watch for extra fees, including withdrawal charges, inactivity fees, and fees for additional services. Choose an app with a clear fee structure that aligns with your investment plan and trading frequency.

Investment Options

A reasonable investment app offers multiple investment options. If you need diverse investment opportunities, look for apps that offer stocks, bonds, ETFs, mutual funds, and even cryptocurrencies. Features such as auto-investing and prebuilt diversified portfolios can be beneficial for passive investors.

Customer Support

Excellent customer support is essential, especially for services managing your money. Ensure the app provides support from skilled, prompt, and responsive customer service professionals. Effective support can resolve issues quickly and is often available through multiple channels, including live chat, email, and phone.

Monitoring Compatibility

The app must fit well with your financial goals and investment strategy. Whether you are saving for retirement, building emergency funds, or investing for short-term goals, the platform should offer the necessary tools and resources to support you.

Reviews and Reputation

Before downloading an app, read user reviews from individuals who have firsthand experiences using it, and check its reputation on credible platforms such as the App Store.

Conclusion

When selecting the appropriate investment application, taking a few minutes to review all these points will ensure you choose an app that suits your needs and helps you invest more effectively. Indeed, the best app in the market is the one that ensures your money is growing appropriately and in a secure environment, so be careful in your selection with thorough research.

Recommended For You

How to Make the Most of Your Money

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.