SBI Small Cap Fund: Invest in Future Market Leaders

The SBI Small Cap Fund is an equity-based mutual fund with a small-cap bias. This fund is primarily a small-cap fund, but under different market conditions may change the composition to a mid-cap leaning fund to adapt to the prevailing conditions. As the fund is equity-based it is exposed to market volatility. Along with the equity mix in the fund, there is a small component of debt and cash or cash equivalent instruments to provide the fund with a certain level of stability. This fund does not give the investor any size-able returns in short investment periods but can reward the investor handsomely over longer investment horizons of at least 5 years.

Contents

TogglePerformance

The SBI Small Cap Fund has been performing very close to its benchmark, the Nifty Small Cap 250 over the last few months, but has historically outperformed this benchmark by a considerable margin. In 2017 this fund saw huge jumps in its performance when compared to its performance in 2016. This fund did not perform well over a short period of time as it has a Compounded Annual Growth Rate (CAGR) of -7.47% over 1 year but performs fairly well over a longer investment horizon as it has a CAGR of 14.65% over 3 years and 29.65% over 5 years. In March 2018 the fund took a big hit and saw its NAV nose-dive from Rs. 51.79 to Rs. 40.71 in a matter of days, the fund has never fully recovered from that but has stabilized over the past few months and the NAV as on December 11, 2018, stands at Rs. 35.02. The fund carries a slightly high beta for its category of 0.82%, but also carries a considerable high alpha for its category of 8.38%, making this fund slightly more volatile than its peers but providing investors considerably higher returns.

Investment Strategy

The SBI Small Cap Fund is a highly diversified mutual fund and employs a dynamic investment strategy as this is an open-ended fund. The fund primarily invests in small-cap and mid-cap companies, but under certain circumstances also invests in large-cap companies to adapt to the prevailing market conditions. The highly diversified investment basket allows the fund to maintain a relatively high alpha. The fund also invests a nominal amount in debt and other stable money market instruments to provide the fund with a level of stability.

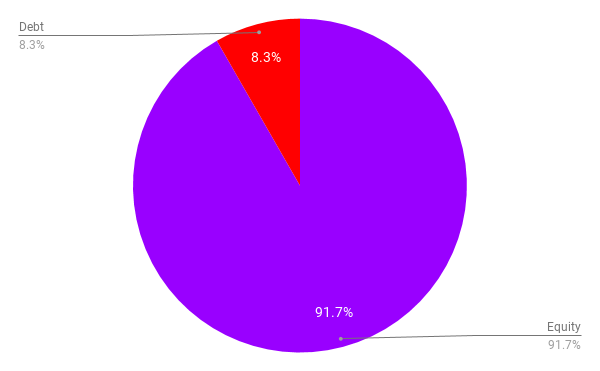

Asset Allocation

The fund according to its mandate has to invest a minimum of 65% in equity and can invest a maximum of 10% in Real Estate Investment Trusts (REIT) or Infrastructure Investment Trusts (InVIT). The asset allocation according to the mandate is present in the table below:

| Instrument | Min Investment | Max Investment | Risk Profile |

| Equity and Equity-related instruments of Small cap companies | 65% | 100% | High |

| Equity and equity-related instruments across market capitalization | 0% | 35% | High |

| Units issued by REIT and InVIT | 0% | 10% | Medium to High |

| Debt | 0% | 35% | Medium |

| Money Market | 0% | 35% | Low |

The current asset allocation of this fund has been shown in the pie chart below:

| Asset | Allocation% |

| Equity | 91.71 |

| Debt | 8.29 |

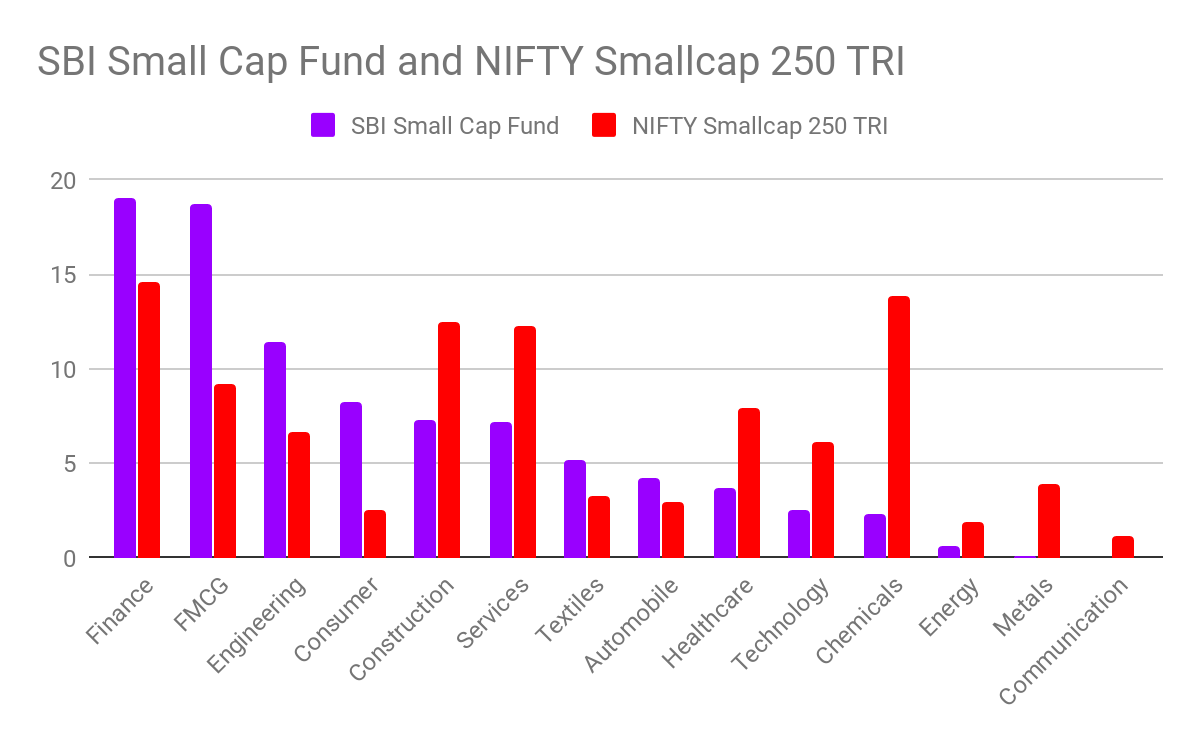

Portfolio

The SBI Small Cap Fund has a highly diversified portfolio across sectors of the economy.

The fund currently invests a large majority of its corpus in Finance, FMCG, Engineering and Consumer Durable sectors of the economy. A chart showing the investment of the fund against the investments of the benchmark index has been provided below:

Fund Manager

Mr. R. Srinivasan

Mr. R. Srinivasan comes with several years of experience in the Indian equity market. Before joining SBI Funds Management Private Limited as a Senior Fund Manager in 2009 he worked with Future Capital Holding, Principal PNB, Blackstone, Indosuez WI Carr, and Motilal Oswal. Mr. Srinivasan has a postgraduate degree in Commerce and has also received a Masters in Financial Management from the University of Mumbai.

Peer Comparison

| Fund | CRISIL Rating | Minimum SIP Investment | Minimum Investment | 3 Year Returns | 5 Year Returns | Fund Size (Cr.) |

| Aditya Birla Sun Life Small Cap – Direct – Growth | 3 | Rs. 1,000 | Rs. 5,000 | 10.71% | 21.88% | Rs. 2,019.96 |

| L&T Emerging Business Fund – Direct – Growth | 4 | Rs. 1,000 | Rs. 5,000 | 16.97% | 19.98% | Rs. 5,162.98 |

| HDFC Small Cap Fund – Direct – Growth | 4 | Rs. 1,000 | Rs. 5,000 | 17.22% | 22.24% | Rs. 5,319.99 |

Recommended For You

The Real Ways to Make Money Online

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.