Using a Term Insurance Calculator to Estimate Your Insurance Needs

When it comes to securing the financial future of your loved ones, term insurance emerges as a cornerstone.

But, with an array of plans and coverage options available, determining the exact insurance requirement can often seem like navigating through a maze. This is where a term insurance calculator becomes an invaluable tool. It not only simplifies the process of estimating your insurance needs but also ensures that the coverage is tailored to your specific circumstances and requirements.

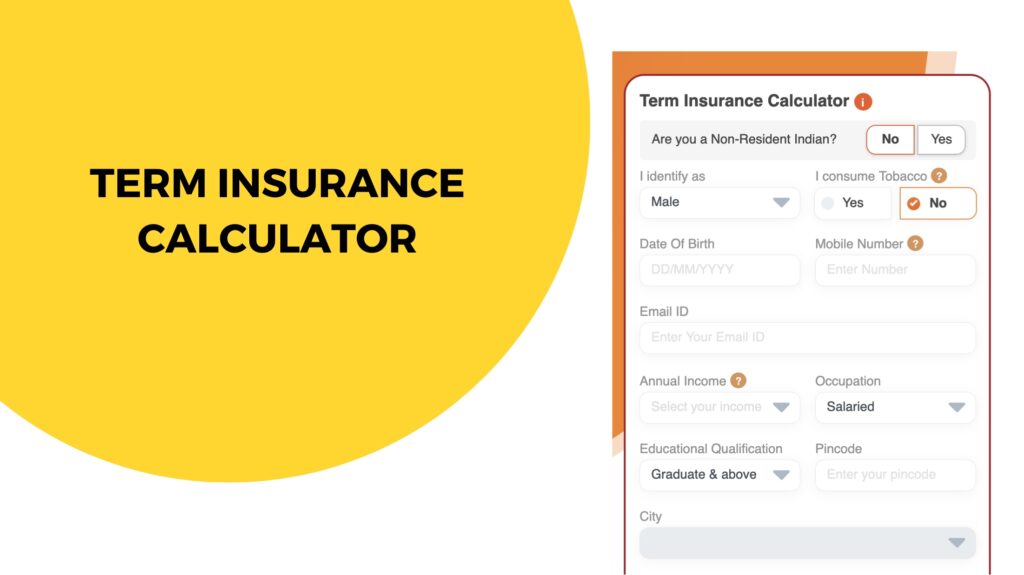

A term insurance calculator is an online tool designed to help you determine the adequate sum assured and the premium amount for your term insurance policy. By inputting basic information such as age, income, financial liabilities, and lifestyle habits, you can estimate how much insurance coverage you need and what it might cost you.

This level of customization and precision is crucial for effective financial planning.

Contents

ToggleThe Benefits of Using a Term Insurance Calculator

1. Customized Insurance Planning: Each individual has unique financial commitments and goals. A term insurance calculator considers personal factors to provide a coverage estimate that aligns with your needs. Whether you have a loan to pay off or plan for your children’s education, this tool helps ensure that your insurance plan covers these essential aspects of your life.

2. Cost-Effective Policy Selection: Premiums for term insurance plans can vary significantly based on the coverage amount, term length, and additional riders. A term insurance calculator enables you to experiment with different variables, helping you find a balance between adequate coverage and an affordable premium. This way, you can secure a policy offering the best investment value.

3. Informed Decision Making: You’re better equipped to compare various term insurance policies with a clearer understanding of your insurance needs. This knowledge empowers you to make informed decisions, choosing a plan that meets your coverage requirements and offers competitive pricing and benefits.

4. Time Efficiency: Calculating your insurance needs can be time-consuming and prone to errors. A term insurance calculator simplifies this process, providing instant estimates. This quick and easy method saves you time, allowing you to focus on other aspects of your financial planning.

5. Planning for Future Financial Security: The primary purpose of term insurance is to ensure the financial security of your dependents in your absence. By accurately assessing your insurance needs, a term insurance calculator helps plan for various future financial obligations, thereby ensuring peace of mind for you and your loved ones.

How to Make the Most Out of a Term Insurance Calculator

To fully benefit from a term insurance calculator, you must be as accurate as possible with the information you provide. Consider your current income, debts, future financial goals, and other factors affecting your family’s financial security. Additionally, it’s wise to reassess your insurance needs periodically, as changes in your life situation (such as marriage, the birth of a child, or a new mortgage) can significantly impact your coverage requirements.

In conclusion, a term insurance calculator is more than just a tool for estimating premiums; it’s a comprehensive planning aid that ensures your term insurance policy adequately protects your loved ones’ future. By leveraging this tool, you can confidently navigate the complexities of term insurance, secure in the knowledge that you’ve made a well-informed, customized choice that safeguards your family’s financial well-being.

Recommended For You

Important Things You Need to Know Before Selling Your Life Insurance

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.