What is SIP – 5 Easy Steps to Calculate SIP Return

Contents

ToggleWhat is SIP?

There have been times when, tijoris or gaddis or even dabbas (wheat flour containers) were the medium of savings. All the hard-earned money was stashed in these super-secret locations with very restricted access. However, things have changed drastically in the last few decades and especially after the demonetization period. The government bringing in various measures to encourage household savings to be brought within the industrial usage and not become the food for rodents. So where do we stash the money now, in banks? Not really. The SIP is one of the answers to this question. Just like you sip in cold drink in a hot summer to quench your thirst, SIP can help you satisfy the thirst of savings more than sufficiently.

SIP means systematic investment plan, which helps you to invest money in a mutual fund scheme at such intervals as you may deem fit. SIP and mutual fund are two different things but at the same time are complementary to each other. SIP is a way or medium of investment in a mutual fund, while mutual fund is an investment option by which different investors come together to invest their money with the help of independent professional managing it. SIP helps in saving the money on daily, monthly, and quarterly, half-yearly, yearly or even lump-sum at any given intervals. All this can be done without moving a muscle on a regular basis, with the help of electronic clearing system (ECS).

But Why SIP?

1. Power of Compounding

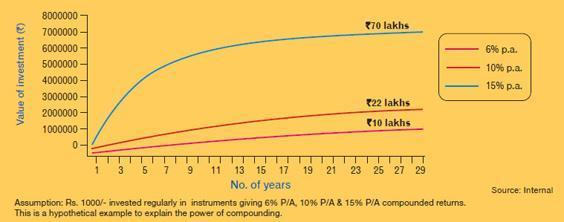

Remember the concept of compounding interest in high school, the same applies to SIP. Over the period of your investment, small amounts of money along with interest earned on such small amount are combined for the entire tenure, which gives you a large amount of sum at liquidation. You can verify this on your own by using SIP calculators by leading companies/banks like L&T or HDFC SIP calculator to understand how the duration of your investment affects your returns. Check out the below graph for example purpose.

2. Safe Investment

The most important factor, since idle money kept in tijoris is always an invitation to thieves, plus it does not grow in these safes. Through SIP your money is not only safe but also increases its value over a period of time. In addition to that SIP is also saves you from government policy changing like demonetization, as hard cash kept at home can be prone obsolescence to income tax or RBI norms.

3. Develops Saving Habit

This is a very important benefit derived under SIP because, usually we end up spending first, saving later and that later never comes due to exhaustion of money. SIP gets deducted straight from your bank account, helping you save first and then spend. Through this, you rearrange your expenses and embrace a savings habit in your profile.

4. Easy entry & exit options

Similar to bank account opening, starting an SIP process is very easy. Just complete your KYC process, fill up the application form and bank mandate, your SIP investment is ready. An even easier proves is the redemption of units bought under SIP, where the units are sold at NAV and money is credited within 2 working days into your bank account.

5. Free to do your Job

Invest in SIP and let the professional and your money do their job. No need to put on the TV or rigorously follow any shares or scrips, SIP keeps your money in safe and professional hands, and leave you unoccupied and stress-free.

6. Rupee cost averaging

The concept is helpful when the cost price is volatile since the SIP is done at regular intervals, some units are bought when the price is high while some are bought when the price is low, which renders the average effective price to be on the lower side.

5 Easy steps to calculate return on SIP.

SIP investment is made at specific intervals, where units of mutual funds are purchased at NAV persisting on the date of investment. Now even though the amount of investment i.e SIP is fixed at every installment, the units purchased are variable at every interval. Therefore, it can be very tricky when the actual return is about to be calculated. But if we follow the following simple steps the calculation on return on SIP will be a piece of cake.

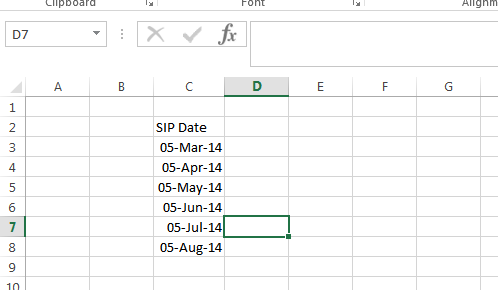

Step 1. Open an excel file and mention all the SIP date of investment under one column. For example, follow the below image.

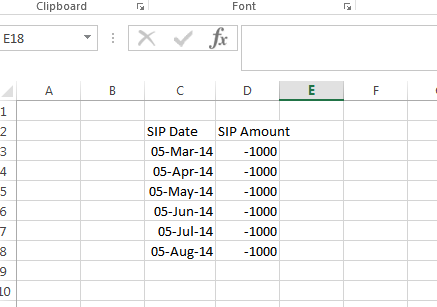

Step 2. Next up is mention all the amounts against their respective dates and mention the amount in negative figures, since it denotes the cash outflow from your bank account. Let us say you invest 1000 per month in SIP, the following is the way you can mention it.

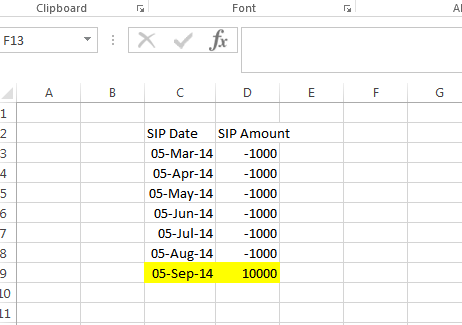

Step 3. Now the crucial step, where in the date column, enter the date on which you need to calculate the return. In the other column enter the total market value of your entire SIP investment. Let us say the date of calculation of return is suppose September 05th 2014 and total market value of Rs. 10,000. However here, while mentioning the market value figure, mention the same in positive figure. Take a look below how to mention the figures.

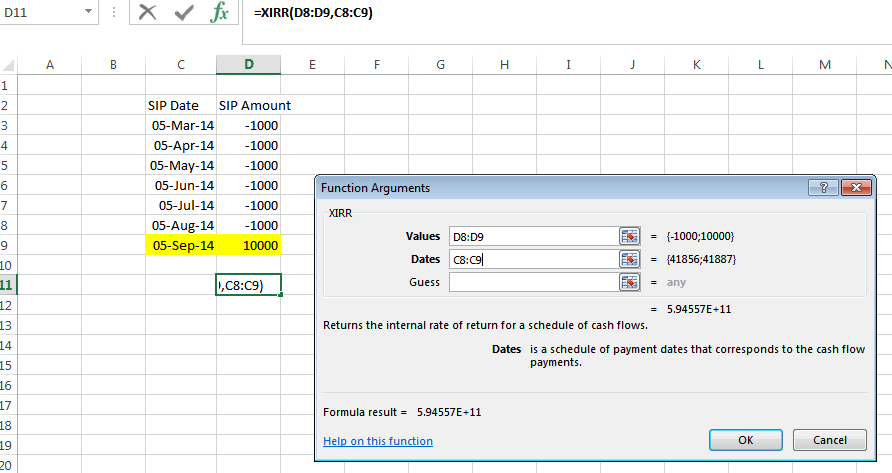

Step 4. Next up is the utilization of blank cell and make use of the XIRR function. To simplify go to quick access toolbar at the top center of any excel file. Choose the formulas tab, choose financial tab scroll to the bottom and choose the XIRR function. Thereafter a pop-up will arise where for values select the cells with SIP amount along with the market value and for dates select the cells with SIP dates and date of market value. Ignore the guess field and proceed by clicking on ok button.

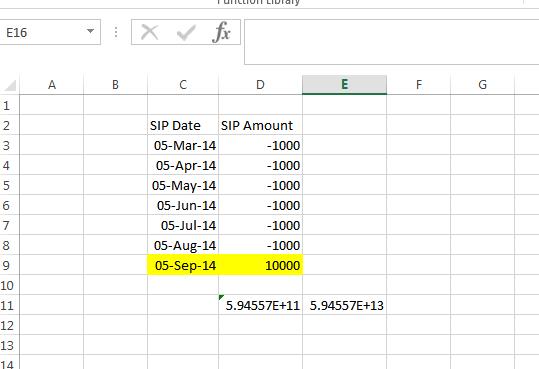

Step 5. Now for the final step whatever figure comes from XIRR, multiply the same by 100 in order to ascertain the percentile of return earned through your investment. In our example, the rate of return is 5.94% as seen below.

You can also use the Orowealth SIP calculator to get an estimate of your returns that you invested in mutual funds. The calculator will give you an insight into how much money should be invested through SIP to gain better returns in the future.

Recommended For You

A Millionaire Bitcoin Investor Shares His 5 Secrets For Financial Success

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.