All The Ways Mobile Banking Has Uprooted Consumer Banking

Mobile banking has transformed consumer banking in the past decade. The growing popularity of mobile apps has put customers in control of their money and encouraged them to take control of their financial lives. Mobile banking has made it easier for customers to open and manage accounts, pay bills, and even make loans and investments without the need for a bank branch. Below are some of the ways mobile banking has transformed the banking industry.

Contents

ToggleMobile Banking Can Help Save Money

Mobile banking can help you save money in several ways. First, mobile apps make it easier than ever to manage your bank account and track your spending on the go. You can also set up automatic payments and send money to other people’s accounts using the app. Second, many banks offer programs that help you save on mobile fees by rewarding you for using your bank’s mobile app.

Finally, mobile apps give you more control over your spending and allow you to make decisions about your spending without having to talk to a bank representative. By using mobile banking, you can better manage your money and create more wealth for your future.

Mobile Banking Is Convenient and Easy to Use

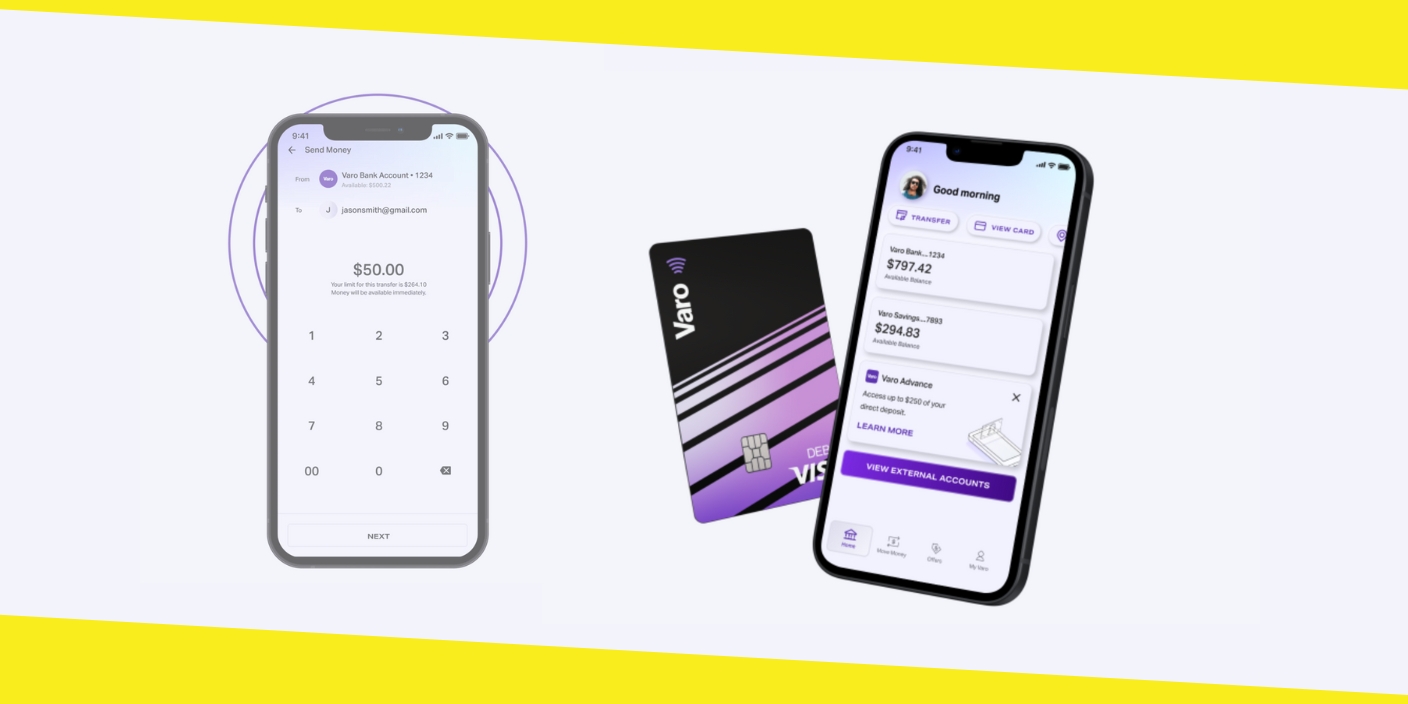

Mobile banking is convenient and easy to use. It’s not hard to open an account or set up a deposit slip, and you can send money or make payments quickly and easily. You can also pay bills and transfer money between accounts using the app. You can even set up automatic payments and manage your investment portfolio. With a smartphone, you can make financial decisions in a few clicks of the app.

The process of using a bank app is so easy that you may not even notice how it’s working. You can use your phone to open an account and make transfers whenever and wherever you want. It is easier to use a bank app than to visit a bank branch. In addition, most banks have developed mobile apps that are available for free on the App Store or Google Play.

No High Fees to Pay with Mobile Apps

There are no high fees to pay with mobile apps. In fact, many banks offer rewards points to encourage you to use their mobile apps. When you open an account and make deposits with your mobile app, you get rewards points that you can use for rewards or bonuses. These rewards can be used to upgrade your account and receive additional services. In addition, many banks offer no-fee deposits, which means you can deposit cash into your account without paying any fees.

Many mobile apps also allow you to track your spending and monitor your savings using a dashboard. You can see how much money you have on your account and compare it with the money you should have on hand. This helps you to make more informed financial decisions.

Easier Foreign Currency Transfers

A lot of people are uncomfortable sending money internationally because they think it will cost them a lot of money. But now there is a new solution to this problem! You can use mobile banking to send money internationally without paying any additional fees. You can use your mobile phone to send money to anyone in the world for free! Now that’s convenient!

Easy to Set Up

In order to use a mobile banking app, you just need to download it from your smartphone’s App Store or Google Play. Once the app is downloaded, you will need to create an account and enter your payment details. Then you can start using the app to make financial transactions. In most cases, you can use the app to manage your bank account without visiting the bank branch.

Conclusion

Mobile banking has made a significant impact on the banking industry. It has made it much easier to manage your finances without having to visit the bank branch. Many banks have developed their mobile apps to reach their target audience easily. This has increased the popularity of mobile banking and given users more control over their finances. However, some banks have tried to ban the use of mobile apps to reduce their operating costs. Many have switched from traditional banking to independent digital banking companies which offer a range of services. This has created a healthy competition in the market. The number of independent digital banks has increased over the years and there is no end in sight to their growth.

Recommended For You

The Future of Marketing: Embracing Hyper-Personalization

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.