5 Essential Features to Consider When Selecting an Online Business Check Service

If you are used to checks, then you know that the cost of ordering new checks from banks can add up very quickly. If your financial institution does not provide free checks, you’ll have to order your checks from somewhere else.

While running a business can be an exciting experience, you’ll need to be extra vigilant to keep your business expenses under control. This is something that business owners need to remember any time they write a check. Ironically, the very checks that remind us of the cost of running a business can be a golden opportunity to save money.

Ordering your business checks online allows you to cut costs without sacrificing security and quality. In fact, by ordering business checks online, you can save anywhere between ⅓ and ½ the cost of ordering checks from your bank.

Other additional benefits come from buying checks online, and also unique features that vary from one provider to another. Do your research on the different check printing services before ordering your checks so you can know who fits the bill.

Contents

ToggleEssential Features to Look in a Check Printing Service

1. Variety of Checks and Add-ons

The process of choosing which check printing service to use starts with knowing the types of checks right for your business. There are different types of business checks to consider, including:

Payroll Checks

Paychecks are used when paying employees. You can find then in both laser and manual forms. They come with deduction captions for state, local and federal taxes.

Laser Checks

These are checks that you can drop them into a printer and fill them out using your computer. Be sure to confirm that the check service you select is compatible with your accounting software.

Manual checks

Manual checks are filled by hand using a pen. They come in different forms, including a 3-to-a-page, which you can carry around when traveling.

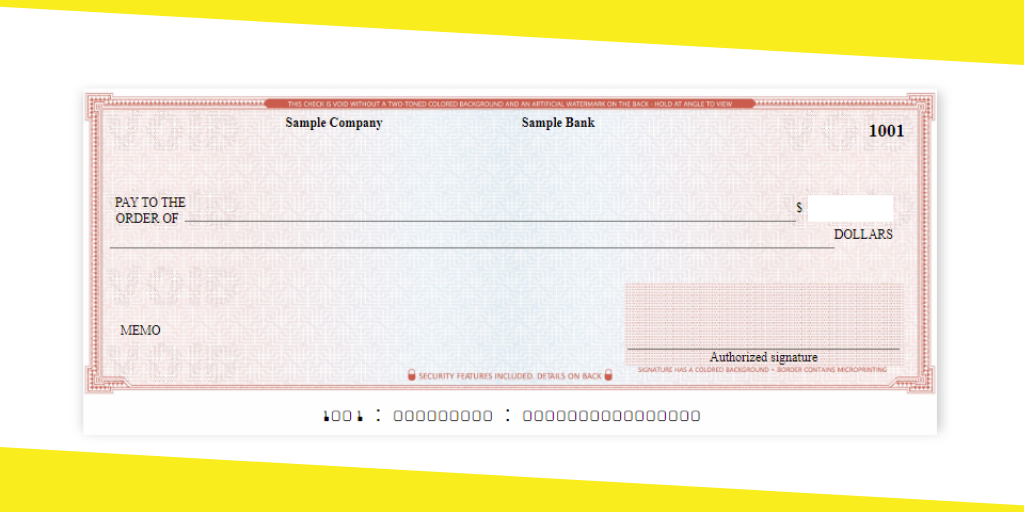

High-Security Checks

While any check, including the one obtained from banks, includes security measures, high-security checks include extra safety measures such as heat-sensitive ink, watermarks, chemically sensitive paper, invisible fluorescent fibers, and anti-copy technology.

Check printing services provide all of the above check options with various methods of tracking checks, like duplicate copies of registers. It is also important to check whether they contain accessories like the binders, endorsement stamps, or deposit tickets.

Some online check services offer additional customization options, such as the option to include your company’s logo on the check.

2. Money-Back Guarantee

Your check ordering service needs to guarantee your money back if your order has not been appropriately processed, or if your check bears false information. The nature of payments, as well as your bank information, is susceptible. You cannot, therefore, afford to have errors in your name, account number, address or even your address.

While you should double-check your details properly before submitting your order, the check ordering company should devise ways to confirm they have the right information before printing. Nevertheless, mistakes do happen and it is important to know you’ll be compensated if something goes wrong.

3. The Cost of Shipping and Time

Different services have different shipping times and costs. Typically, each provider offers different shipping options at different prices. Times can be between 2 and 14 days, or even more. If you’re buying business checks in a hurry, you should choose a service that ships the checks within a short time.

The cost of shipping depends on your order’s weight and your location in the US. Remember that customized orders will take more time than normal orders.

4. Price

While you’ll save money when you order checks online compared to when you order them in your bank, there is some difference between the various types of checks and multiple providers. Generally, you’ll be charged more for laser checks than manual checks. You’ll also be charged more for checks with additional features.

Be sure to consider the number of checks in a set when comparing prices. Also, it is important to find out whether a company offers a discount when you order in bulk. Choose the one with a favorable discount.

5. Security

When it comes to sensitive information such as your account details and your business finances, you’d surely want to ensure that you’re giving them out to a reputable company. When providing your banking information online, make sure that the company you’re dealing with has employed proper security measures and has ways to encrypt your personal details.

Besides, you’d want to ensure that your check follows the security guidelines set by Check Payment Systems Association (CPSA).

Recommended For You

How Should You Structure Your Employee Recognition Programs?

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.